Proven Ways to Improve Credit Score Fast in 2025

Proven Ways to Improve Credit Score Fast in 2025. Having a strong credit score is more important than ever. Whether you’re applying for a mortgage, car loan, or even a new credit card, lenders look at your credit score to determine your financial trustworthiness. If your score is lower than you’d like, the good news is there are proven strategies to improve credit score fast. With the right approach, you can start seeing results in just a few months.

Let’s break down everything you need to know about boosting your credit score quickly and effectively.

Understanding Your Credit Score

What is a Credit Score?

A credit score is a three-digit number, typically ranging from 300 to 850, that reflects your creditworthiness. It’s calculated based on your credit history and shows lenders how responsible you are with borrowing and repaying money.

Why a Good Credit Score Matters

A higher credit score can save you thousands of dollars in interest rates over your lifetime. It helps you:

-

Qualify for better loan offers.

-

Get approved for credit cards with higher rewards.

-

Lower your car insurance premiums.

-

Increase your chances of renting a house or apartment.

Key Factors That Affect Your Credit Score

To improve your credit score quickly, you need to understand the elements that shape it.

1. Payment History (35%)

Your record of on-time payments is the most important factor. Even one missed payment can hurt your score.

2. Credit Utilization Ratio (30%)

This measures how much of your available credit you’re using. Keeping your utilization below 30% is ideal.

3. Length of Credit History (15%)

Older accounts help your score since they demonstrate long-term credit management.

4. New Credit Inquiries (10%)

Each hard inquiry when applying for new credit can lower your score slightly.

5. Credit Mix (10%)

A mix of credit types—such as credit cards, auto loans, and mortgages—can improve your score. Proven Ways to Improve Credit Score Fast in 2025

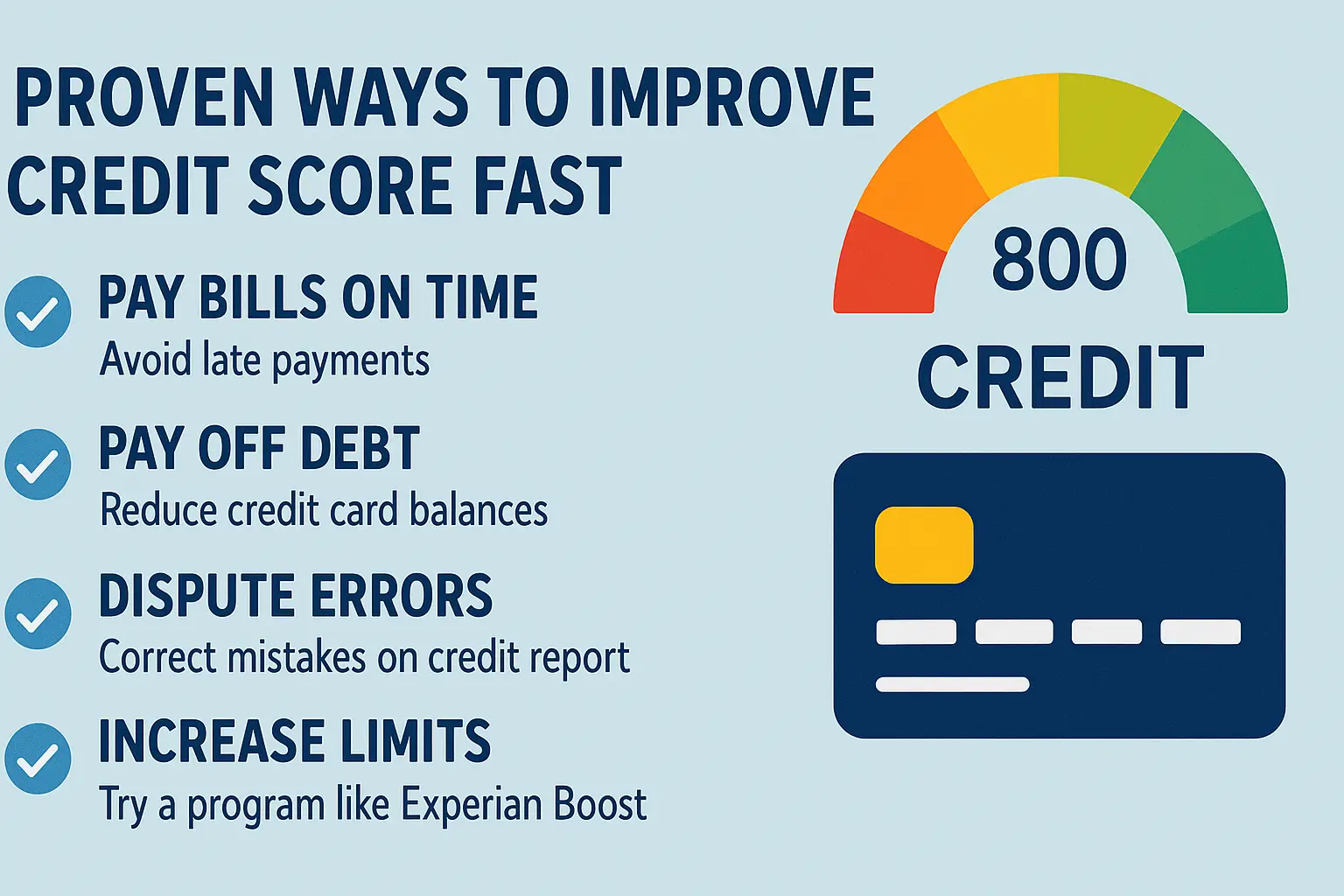

Quick Steps to Improve Credit Score Fast

1. Pay Your Bills on Time

This may sound simple, but timely payments are the single most effective way to boost your credit score. Setting up automatic payments or reminders can help avoid late fees.

2. Reduce Your Credit Card Balances

High credit card balances relative to your limit can drag your score down. Aim to pay off high-interest cards first and keep utilization under 30%.

3. Avoid Applying for Too Much New Credit

Multiple applications within a short period can signal financial distress. Apply only when necessary.

4. Ask for a Credit Limit Increase

If you have a good payment history, request a higher credit limit. This instantly reduces your credit utilization ratio, which boosts your score.

5. Become an Authorized User

Ask a family member or friend with good credit to add you as an authorized user on their card. Their positive history can help raise your score.

Advanced Strategies to Boost Your Credit Score

1. Dispute Credit Report Errors

Errors on your credit report can unfairly lower your score. Review your reports from Equifax, Experian, and TransUnion for inaccuracies and dispute them immediately.

2. Negotiate with Creditors

If you have late payments or collections, try negotiating a “pay-for-delete” arrangement where the creditor removes the negative mark after payment.

3. Consider Debt Consolidation

If you’re juggling multiple high-interest debts, consolidating them into one lower-interest loan can make payments easier and improve your utilization ratio.

4. Use Experian Boost or Similar Tools

Experian Boost lets you add utility and phone bill payments to your credit report, which can help you see a quick increase in your score.

Smart Habits to Maintain a High Credit Score

1. Monitor Your Credit Regularly

Use free services like Credit Karma or paid monitoring tools to track your progress and catch fraud early.

2. Keep Old Accounts Open

Closing old accounts shortens your credit history, which can lower your score. Keep them open, even if you rarely use them.

3. Diversify Your Credit Mix

Having both revolving credit (credit cards) and installment loans (personal loans, auto loans) helps demonstrate financial responsibility.

Common Mistakes to Avoid While Improving Credit Score

-

Paying the minimum balance only – It keeps debt high.

-

Closing credit cards – This reduces your available credit and hurts utilization.

-

Maxing out cards – High balances are a red flag to lenders.

-

Ignoring credit reports – Errors can stay on your report for years if not corrected.

Frequently Asked Questions (FAQs)

1. How fast can I improve my credit score?

You can see results in as little as 30 to 90 days if you pay down debt and avoid missed payments.

2. Does paying off debt immediately boost credit score?

Yes, reducing balances can lower your utilization ratio, which often raises your score quickly.

3. Can I improve my credit score without a credit card?

Yes, by paying bills on time, disputing errors, and using services like Experian Boost.

4. How often should I check my credit score?

Monthly monitoring is best to catch errors and track progress.

5. Will closing old credit cards improve my score?

No, it usually lowers your score by reducing available credit and shortening your history.

6. What’s the fastest way to go from bad credit to good credit?

Paying bills on time, lowering balances, and disputing errors are the most effective strategies.

Conclusion: Start Improving Your Credit Score Today

Improving your credit score fast requires discipline and smart financial decisions. From paying bills on time to lowering credit card balances and disputing errors, these steps can help you see results in just a few months. The key is consistency—once your score improves, maintaining good habits ensures it stays strong.

A higher credit score means better loan approvals, lower interest rates, and greater financial freedom. Start today, and you’ll thank yourself tomorrow.